"“We engaged with Shepherd on a very large construction project and found that their team qualifications to understand the risk met and surpassed expectations. Throughout the entire process, their responsiveness and service model makes working with them feel like a breath of fresh air as they are incredibly efficient and truly work for the benefit of the Insured to understand the business needs and risk. I already have come back to Shepherd with several additional opportunities and am excited to continue working with them!” "

OCIP

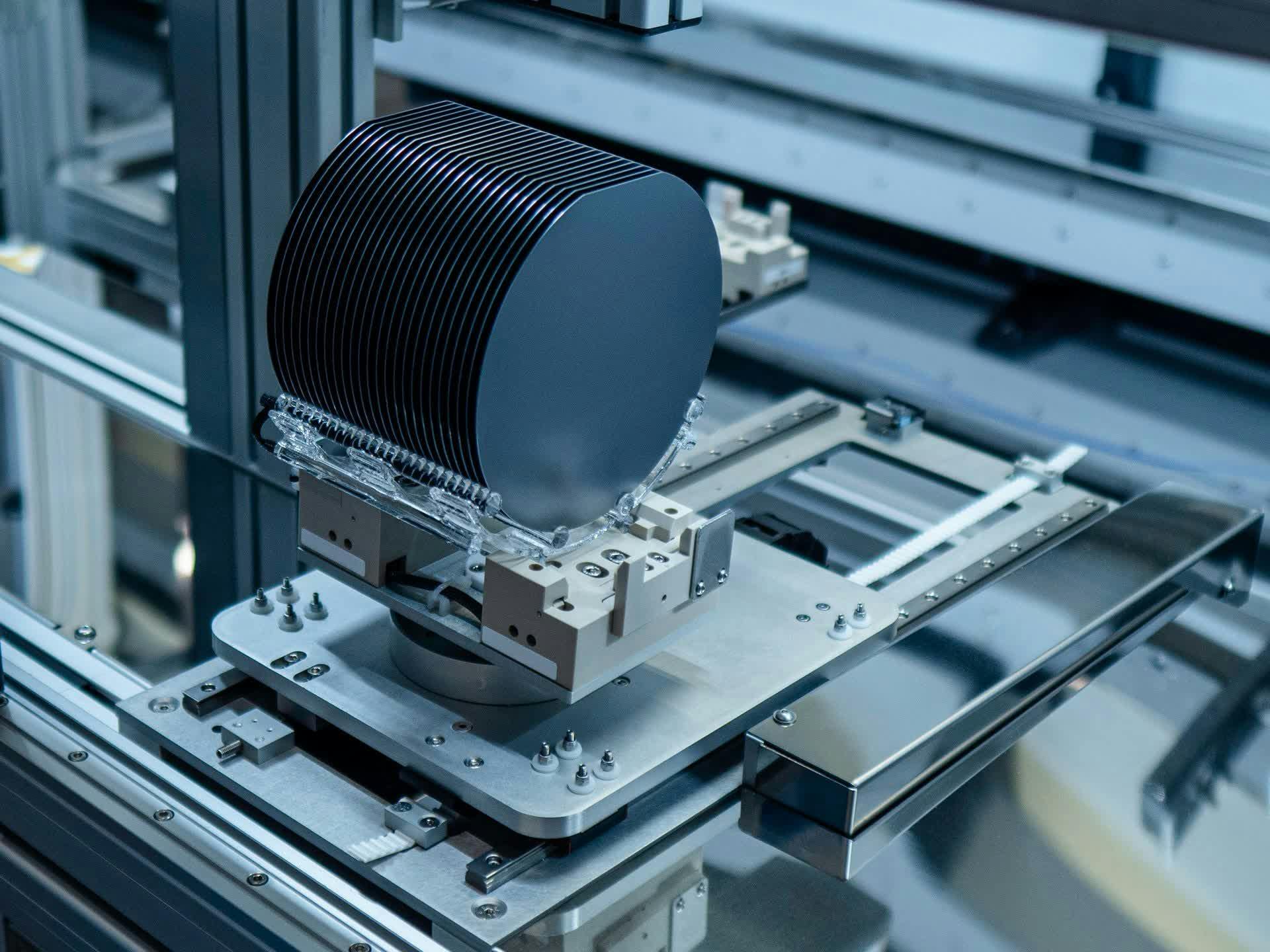

Semiconductor-fabrication facility construction project in Texas

48-month project

$10M x $15M x P project excess liability policy

We received this OCIP submission shortly after an in-person meeting with the broker team. We provided our initial indication within 5 hours. We sent our formal quote within 3 business days of receiving the underlying details which solidified our position in the excess tower.

At a capabilities meeting in November we introduced Shepherd’s capabilities, appetite, and specimen form. This opportunity was immediately identified as a project with a strong appetite fit and where we could competitively provide coverage in the excess program. Throughout the process, we worked closely with the producer to ensure all coverage needs were met while maintaining competitive pricing.

Underwriting Profile

Underwriter

Lindsay Plotkin

Underwriting Lead

More Case Studies

$202M apartment complex project in North Carolina

$10M project excess liability policy for a 30-month project

Owner Receives 15% Premium Savings with OpenSpace Activation on $260M OCIP in Atlanta

Savings

$10M Mechanical Contractor in New Jersey

$5M excess liability policy for contractor practice program

Any appointed broker can send submissions directly to our underwriting team