Maureen MacIsaac

Product Lead

May 22, 2023

Contractors today have access to more technology and operational data than ever before. From next-generation video reality capture on jobsites to telematics revolutionizing fleet safety management, the suite of options offers meaningful benefits for every contractor. Yet, when we talk to brokers and policyholders it is clear there is still a huge information gap between insurers and operators in construction.

We get asked all the time: “I want to know how my client is performing compared to their peers.” “My auto losses are trending up - should I be worried?” “If this contractor wants to expand operations in this state, how will it impact their premium?” We see this information gap playing out as a worrying macro trend. US construction productivity has declined by 40 percent between 1970 and 2020 despite significant capital investment. If we want contractors to be more productive, insurance carriers have to provide the information and incentives to get there.

Today, we are excited to announce a groundbreaking product to help bridge this data gap: Shepherd Insights. a comprehensive, actionable report that benchmarks a contractor’s risk profile against a cohort of similar peers. Designed to empower industry professionals and change the way brokers and contractors identify and manage risk.

Shepherd Insights complements our launch of Casualty Pro last year, where we at Shepherd reward contractors for their use of technology that makes them safer, more productive, or more efficient. Over the past year we’ve expanded to utilize data from three top-tier partners: Procore, OpenSpace and Autodesk. The response from the construction industry has been enormous. Nearly 50% of submissions we receive are from contractors who utilize at least one of these tools.

Insurance claims are an unfortunate reality for contractors. Construction is a high hazard industry, and jobsite losses do happen. But operational exposure differs widely across the construction landscape. Larger contractors with hundreds of millions of dollars in payroll and thousands of vehicles in their fleet have larger surface area and therefore are more likely to experience claims. Similarly, we know some classes and jurisdictions of work are riskier than others. We wanted to take an “apples to apples” approach in benchmarking contractors, to ensure any analysis is a meaningful comparison and not just noise.

To that end, we group contractors into peer cohorts based on three components:

Annual sales revenue (total amount of construction volume per year)

Type of contractors - General Contractors and Trade Contractors

Location of operations

Every contractors will be bucketed with similar peers in these categories to compare performance. Meaning if you’re a larger trade contractor based in a high-risk jurisdiction like California or New York, your frequency will tend to be higher than, for instance, smaller GCs based in low risk jurisdictions like North Carolina. For either contractor, we can share whether this company's losses are at higher frequency or severity than the rest of their peer cohort.

Shepherd brings together the best of technology, providing a smooth, intuitive, digital-first broker experience that puts exceptional service front and center. We know that everyone is tired of paperwork. That’s why we made the Shepherd Insights report run entirely on submission data.

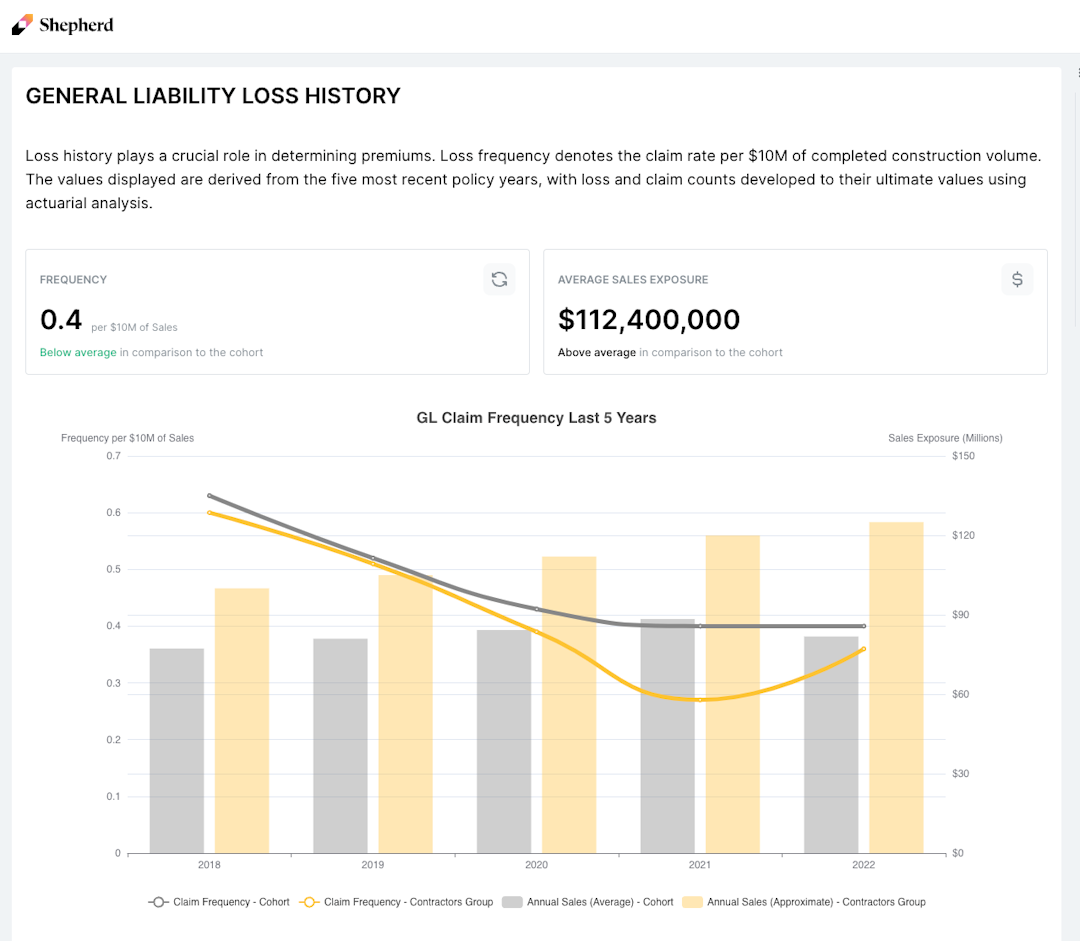

The process is simple: we receive data with every insurance submission for general liability and auto liability excess casualty coverage (and soon, primary casualty). That data covers four broad areas: operations scope (what work is done, and where), auto fleet detail, general liability losses and auto liability losses. Our team rapidly cleans, enhances and reviews the data using a combination of external data integrations, AI tools, and expert review from our in-house underwriting and actuarial teams.

The bottom line? We can automatically produce this report in one click with no extra steps or information from brokers or contractors.

We know brokers and contractors want their underwriters to be transparent partners. Armed with the information from a Shepherd Insights report, brokers can be more informed about their client performance and contractors can develop targeted risk mitigation strategies - improving program outcomes.

Our easy-to-understand report develops claims to make it easy to compare between contractors, and across years, bringing focus to strengths and opportunities. There are four sections in the report:

Details jurisdiction and amount (payroll or subcost) of each class of contractor operations, automatically identifying the top contributors to CGL premium

Breaks down auto fleet including number and type of vehicles, location, and loss cost drivers

Our automatic claims development models take your claims data and project a truer picture of how losses have, and will, develop - for your contractor and for the market at large.

All Shepherd data is kept secure using our modern technology stack. We don’t sell, license, or share data with any third parties. Our data is aggregated to a peer cohort level, meaning it is anonymized. Benchmarking data can never be traced back to a contractor or broker.

Shepherd Insights are available today for appointed brokers and policyholders. For more information, reach out to support@withshepherd.com or your Shepherd underwriter. If you are a broker but you are not appointed with Shepherd yet, please reach out for appointment information. If you are a contractor but do not hold a Shepherd policy, please contact your insurance broker for more information on how to get a quote that includes access to Shepherd Insights.

Read more from Shepherd

Why Speed Still Wins – But Only When It’s Backed by Value

In construction, time kills deals. Projects move fast, and delays at any stage – from bidding to binding – can cost contractors real money.

Laura Watts

Head of Customer Experience

July 24, 2025

Shepherd Launches Admitted Casualty Lines in California

Announcing new product offerings for California projects and contractors

Justin Levine

Co-Founder & CEO

July 10, 2025

Any appointed broker can send submissions directly to our underwriting team